A recent multinational study conducted by researchers at the University of British Columbia (UBC) sheds light on the relationship between money and happiness, revealing that how people spend their money significantly affects their well-being – and the impact varies widely across regions and income levels.

The research, published in Communications Psychology, examined spending patterns and happiness among 200 participants from seven countries, spanning high-income nations like Canada, the U.S., and the U.K., as well as lower-income nations such as Kenya and Indonesia.

Funded by an anonymous donor and the TED organization, the study represents the largest investigation of its kind into how financial decisions influence happiness across diverse cultural and economic settings.

Participants were given a one-time windfall of $10,000 USD, spending it on a total of 3,225 purchases. They were asked to rate how happy each expenditure made them, with follow-up evaluations conducted six months later to assess changes in overall well-being.

Different spending habits, different outcomes

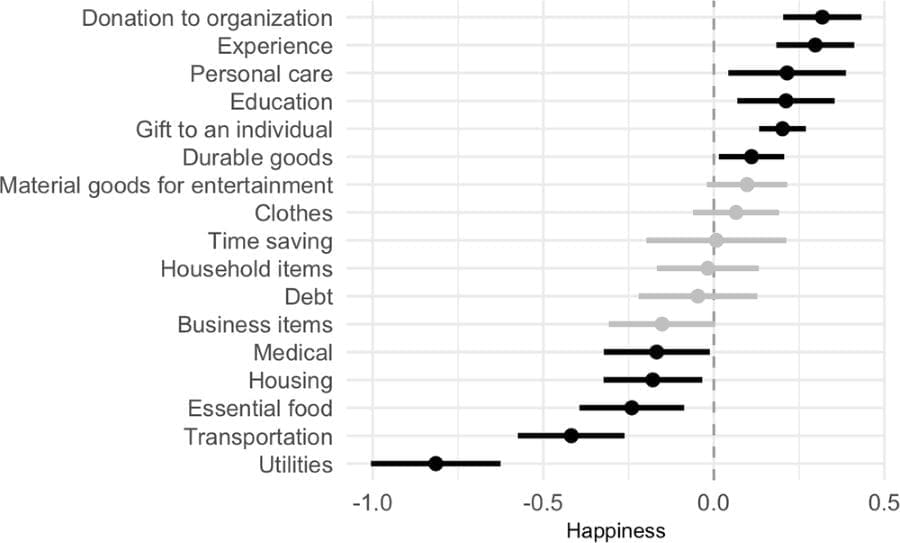

The findings reveal that certain types of spending – such as donations, experiential purchases, and investments in education or personal care – brought happiness across all regions. However, other expenditures, including gifts, time-saving services, and basic needs, showed more varied effects depending on local economic conditions.

“Our research shows that spending on gifts and time-saving services, such as paying for house cleaning or take-away food, led to a greater boost in happiness for those in wealthier nations,” explained Dr. Säde Stenlund, the study‘s first author and a postdoctoral researcher at Harvard University. “On the other hand, paying off debt or paying for housing was perceived as bringing less happiness in the wealthier countries.”

In contrast, participants in lower-income nations derived greater happiness from investments in basic needs and financial stability. “In countries where everyday life involves greater financial stress, paying off a significant debt or securing a home is naturally more impactful,” Dr. Stenlund added.

Long-lasting effects

Regardless of the type of spending, the study found that the happiness resulting from purchases had lasting effects, improving participants’ overall subjective well-being even months after the expenditures.

The researchers identified several spending categories that universally contributed to happiness, including donations, experiences, education, and personal care. These purchases provided consistent emotional rewards across income levels and regions.

Nuances of happiness spending

The study also uncovered key differences:

- Gifts: These provided a significant boost in happiness globally but had an even stronger emotional impact in wealthier nations.

- Time-saving purchases: Services like hiring household help or cutting commuting time were especially valued in high-income nations, where time scarcity is a common stressor.

- Debt relief and housing: While impactful in lower-income nations, these expenditures generated less happiness in wealthier countries.

Dr. Stenlund noted the importance of tailoring financial advice to cultural and economic contexts. “What works in New York might not work in Nairobi,” she said. “Happiness is shaped not just by how much money we have, but by how wisely we align spending with our unique circumstances and needs.”

Advancing financial well-being

The study’s authors hope the findings will inform more inclusive advice on financial planning and happiness. They emphasize that understanding the local context is crucial to helping individuals make spending decisions that maximize well-being.

This nuanced perspective challenges traditional notions about the relationship between wealth and happiness, highlighting how cultural and economic factors influence emotional responses to financial choices.

Journal Reference:

Stenlund, S., Guo, Y., Rights, J. et al. ‘How spending decisions shape happiness in everyday life’, Communications Psychology 2, 124 (2024). DOI: 10.1038/s44271-024-00166-6

Article Source:

Press Release/Material by University of British Columbia

Featured image credit: Freepik (AI Gen)