A recent study published in Environmental Research: Energy shows the importance of robust safeguards in U.S. clean energy tax credit policies.

Researchers from the University of Notre Dame, Princeton University, and the University of Pennsylvania reveal how inadequate regulations in hydrogen production tax credits could lead to significant financial and environmental consequences.

Their findings highlight the potential for saving taxpayers $1 trillion over a decade while averting billions of metric tonnes of CO2 emissions.

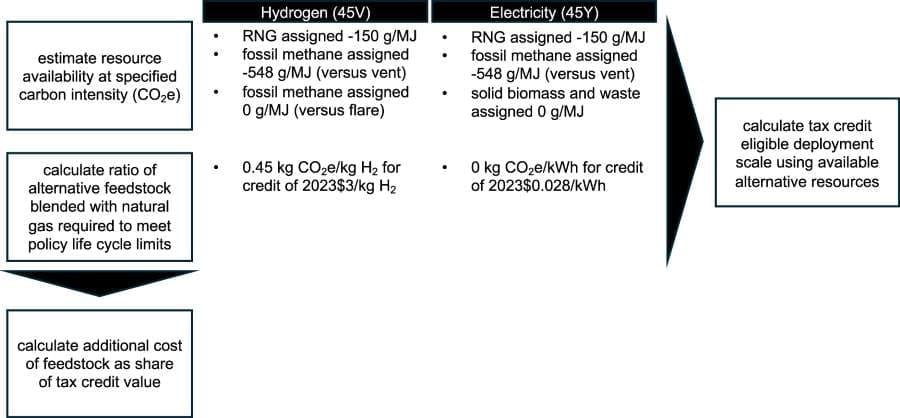

Hydrogen producers are eligible for tax credits under the Clean Hydrogen Production Tax Credit (Section 45V) of the 2022 Inflation Reduction Act. However, the study demonstrates that without stringent safeguards, producers could exploit loopholes by blending fossil-derived methane with biomethane or waste methane, qualifying for maximum credits of $3 per kilogram for “gray” hydrogen production.

This practice could result in 35 million metric tonnes of gray hydrogen annually, imposing a heavy financial burden and contributing to climate harm.

On January 3, 2025, the U.S. Treasury Department finalized regulations addressing these risks, closely following recommendations made in the study. The regulations prohibit the blending of fossil and alternative methane feedstocks and set technical safeguards for hydrogen produced from alternative methane sources. These measures aim to prevent manipulation of carbon intensity scores used to assess eligibility for clean energy incentives.

The life cycle methods required by the 2022 Inflation Reduction Act offer decision support frameworks but are not objective calculators, the researchers explain. Their analysis demonstrates how life cycle methods, if improperly implemented, could incentivize activities that undermine the goals of clean energy policies.

The study identifies three critical recommendations to mitigate fiscal and climate risks:

- Prohibit blending feedstocks to maximize tax credits.

- Allow negative carbon intensity scores only for activities that actively remove atmospheric carbon.

- Assume baseline scenarios that reflect deep climate action, including effective methane management.

The Treasury’s final rules align with the first and third recommendations, prohibiting feedstock blending and requiring conservative assumptions about methane management. For example, hydrogen producers must now assume methane from landfills and coal mines is captured and flared rather than vented, reducing the risk of excessive credits for overstated climate benefits.

While the Treasury did not fully implement the second recommendation, safeguards now limit distortions from negative carbon intensity scores, particularly for methane derived from animal manure.

The researchers emphasize the importance of careful policy design to address potential distortions in clean energy incentives.

“Our point in raising concerns about the application of life cycle analysis in complex environmental policy design is not to object to it on a categorical basis, but to show that it is a mistake to assume it is an objective framework,” they note.

The study also evaluates risks associated with clean electricity tax credits under Section 45Y of the US tax code. Regulations for these credits are expected soon, and the researchers urge policymakers to integrate similar safeguards to ensure the credits deliver meaningful climate benefits.

Subsidies for technologies deemed “clean” based on operational choices that could change post-incentive expiration are another area of concern. The authors suggest adding provisions to reclaim credits if subsidized facilities revert to polluting practices.

This research provides a critical roadmap for policymakers to optimize clean energy incentives, balancing environmental goals with fiscal responsibility.

Journal Reference:

Emily Grubert, Wilson Ricks and Danny Cullenward, ‘Greenhouse gas offsets distort the effect of clean energy tax credits in the United States’, Environmental Research Energy 2, 015001 (2025). DOI: 10.1088/2753-3751/ad9f65

Article Source:

Press Release/Material by IOP Publishing

Featured image credit: IOP Publishing | CC BY