Carbon assurances within the corporate environment is likely to become mandatory in future, and companies that already have systems in place to track and account for carbon emissions would reap the benefits, research from Edith Cowan University (ECU) has found.

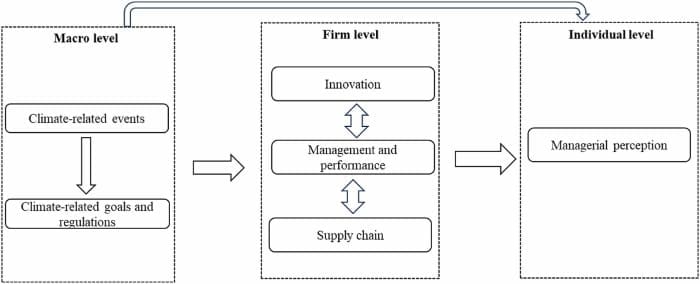

“Carbon assurance is a subset of sustainability assurance that focuses on carbon emissions. So anything from how a company records its Scope 1 and Scope 2 emissions, the technology and innovation methodologies used to mitigate carbon emissions, and carbon emission exposures all fall into this category,” said ECU Lecturer Dr Alex Zhang.

While carbon assurance is voluntary at the moment, Dr Zhang and his team believe it is very likely to become mandatory in future, much like financial assurance.

“This change will be driven by various factors, the first of which is prompting from International Financial Reporting Standards (IFRS) which have proposed a series of mandatory disclosure requirements for climate change, which will include carbon emissions,” said Dr Zhang.

“With mandatory disclosure on climate change now coming into effect, you would expect a greater number of stakeholders and investors looking for assurance to verify a company’s disclosure of its carbon-related information.”

Dr Zhang noted that climate change disclosures by some companies may lack due diligence, leading to incomplete or inaccurate reporting of their environmental impact and sustainability practices.

“Carbon assurance involves independent verification and validation of a company’s carbon emissions and sustainability reports, and it can significantly enhance the quality and reliability of climate change disclosures, addressing the potential lack of due diligence and building trust among stakeholders,” he added.

Dr Zhang noted that the latest research has indicated that stakeholders and shareholders often showed appreciation for a firm’s efforts to adopt carbon assurance.

“Corporate firms, to some extent, are subject to very high demand on carbon reporting. Aside from stakeholders, we as citizens and social actors want firms to be socially responsible. But we also have to bear in mind that corporations, by their very nature, are driven by profits,” he said.

“Companies are unlikely to invest resources in a social issue solely to satisfy the community; there must be some form of return. Our research shows that companies with carbon assurances often experience increased shareholder investment.“

Dr Zhang continued: “Carbon assurance acts as a signal to the market that a firm is able to operate profitably while also being able to help stakeholders maintain the environment and achieve carbon neutrality. In return, companies get a greater return on the book value, and they also get better market returns.”

The research was published in the British Accounting Review.

Journal Reference:

Le Luo, Junru Zhang, ‘A global study of climate uncertainty and carbon assurance’, The British Accounting Review 101425; (2024). DOI: 10.1016/j.bar.2024.101425

Article Source:

Press Release/Material by ECU

Featured image credit: Chris LeBoutillier | Unsplash