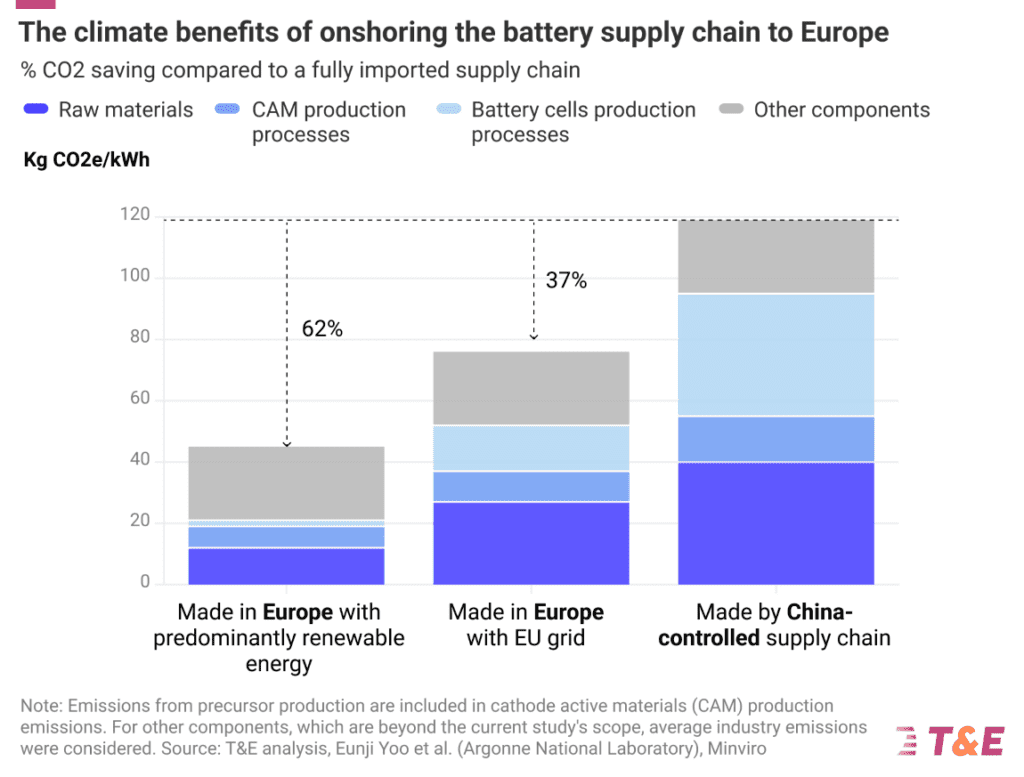

New analysis by Transport & Environment (T&E) reveals that European-made batteries could potentially be up to 60% less carbon-intensive than those produced in China. However, over half of Europe’s battery production plans remain precarious without stronger government intervention.

According to T&E’s findings, onshoring the electric vehicle (EV) supply chain to Europe could significantly reduce emissions associated with battery production. Comparing a Europe-controlled supply chain to one dominated by China, the analysis suggests a 37% reduction in carbon emissions, a figure that climbs to over 60% with the use of renewable electricity.

The potential environmental benefits are substantial. Localizing the production of battery cells and components in Europe could save an estimated 133 Mt of CO2 between 2024 and 2030, equivalent to the total annual emissions of Czechia.

However, despite progress, less than half (47%) of the lithium-ion battery production planned for Europe up to 2030 is deemed secure. This is an improvement from one-third a year ago but still leaves over half of announced cell manufacturing capacity at medium or high risk of disruption without robust government action.

Julia Poliscanova, senior director for vehicles and e-mobility supply chains at T&E, emphasized the critical need for focused governmental support. She stated, “Batteries, and metals that go into them, are the new oil. European leaders will need laser sharp focus and joined-up thinking to reap their climate and industrial benefits.”

France, Germany, and Hungary have made notable progress in securing gigafactory capacity, with France’s ACC starting production in Pas-de-Calais last year, and plants by Verkor in Dunkirk and Northvolt in Schleswig-Holstein, Germany, proceeding with government assistance.

But Finland, the UK, Norway, and Spain face challenges, with significant production capacity at medium or high risk due to uncertainties surrounding projects by various groups, including the Finnish Minerals Group, West Midlands Gigafactory, Freyr, and InoBat.

T&E called on lawmakers to bolster EU electric car policies, enforce stringent battery sustainability requirements favoring local manufacturing, and enhance EU-level funding to solidify investments and mitigate risks.

The report also highlights the struggle to secure other parts of the battery value chain, given China’s dominance and the EU’s evolving expertise. While Europe has the potential to manufacture 56% of its cathode demand by 2030, only two plants have begun commercial operations thus far. Additionally, the region could potentially fulfill all of its processed lithium needs and secure a significant portion of battery minerals from recycling by the end of the decade, but processing and recycling plants require substantial support to scale up effectively.

Julia Poliscanova underscored the urgency of the situation, stating, “The battery race between China, Europe and the US is intensifying. While some battery investments that were at risk of being lured away by US subsidies have been saved since last year, close to half of planned production is still up for grabs. The EU needs to end any uncertainty over its engine phase-out and set corporate EV targets to assure gigafactory investors that they will have a guaranteed market for their product.”

T&E’s analysis serves as a stark reminder of the challenges and opportunities facing Europe’s burgeoning battery industry. With the right policies and support mechanisms in place, Europe has the potential to not only reduce carbon emissions but also establish itself as a global leader in sustainable battery production.

(More information: T&E – Press Release; Read also ‘An industrial blueprint for batteries in Europe’; Featured image credit: Freepik)